Renters Insurance in and around Charlotte

Charlotte renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Charlotte

- Mountain Island Lake

- Uptown

- Northlake

- Mt Holly

- Belmont

- Huntersville

- Ballantyne

- Southpark

- Myers Park

- Cotswald

- Union County

- Weddington

- Waxhaw

- Mecklenburg County

- Iredell County

- Gaston County

- Fort Mill

- Rock Hill

- Denver

- Mint Hill

- Matthews

- Lake Wylie

Home Sweet Home Starts With State Farm

No matter what you're considering as you rent a home - price, outdoor living space, number of bathrooms, house or townhome - getting the right insurance can be crucial in the event of the unexpected.

Charlotte renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

There's No Place Like Home

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects the things inside the place you call home with coverage. If your rental is affected by a tornado or abrupt water damage, some of your belongings may have damage. If you don't have enough coverage, you may struggle to replace the things you lost. It's scary to think that in one moment, the unexpected could wipe out all you've invested in. Despite all that could go wrong, State Farm Agent Tony Hefner is ready to help.Tony Hefner can help offer options for the level of coverage you have in mind. You can even include protection for valuables beyond the walls of your home. For example, if your car is stolen with your computer inside it, your personal property is damaged by a fire or your bicycle is stolen from work, Agent Tony Hefner can be there to help you submit your claim and help your life go right again.

Renters of Charlotte, State Farm is here for all your insurance needs. Visit agent Tony Hefner's office to get started on choosing the right coverage options for your rented home.

Have More Questions About Renters Insurance?

Call Tony at (704) 714-1494 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

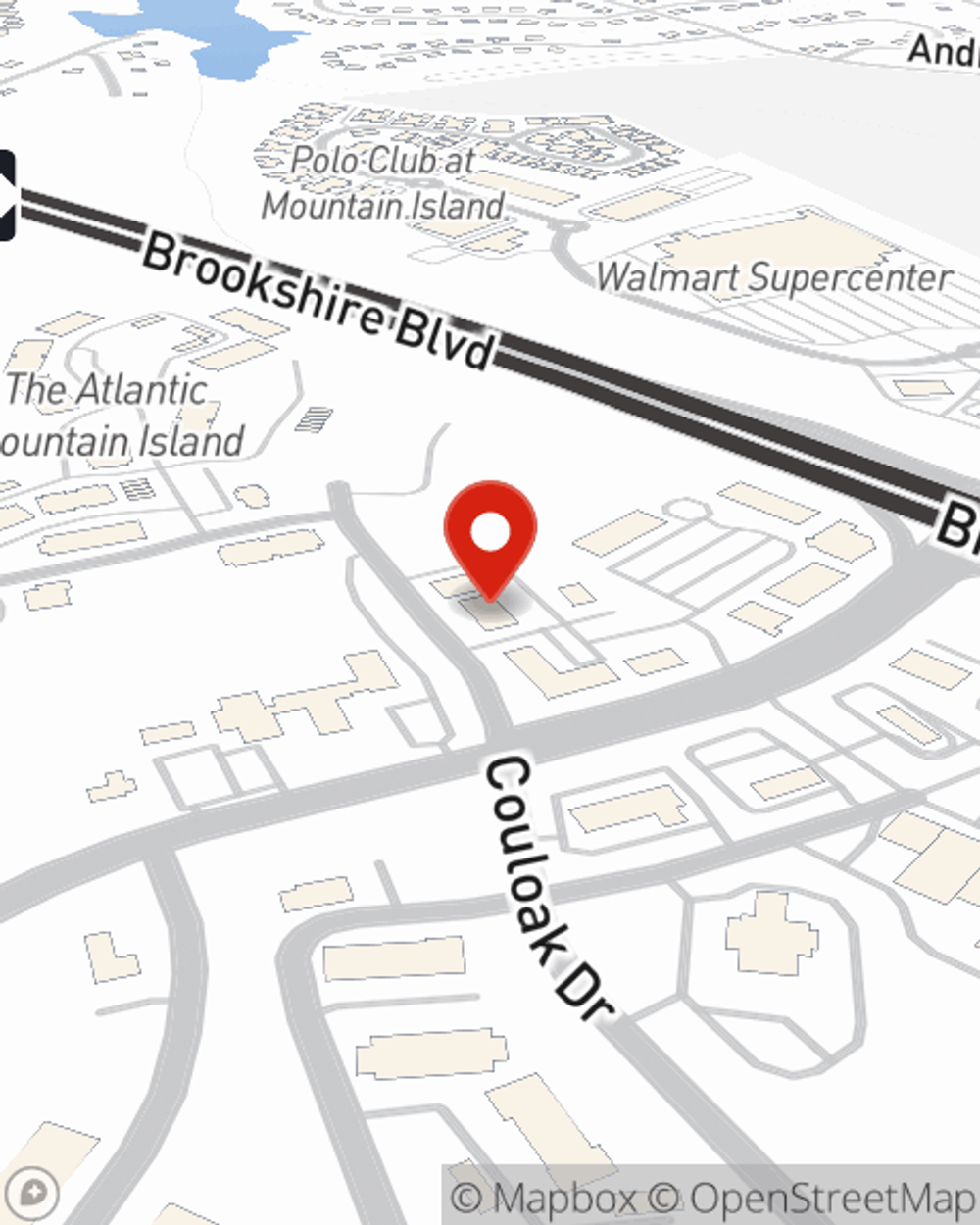

Tony Hefner

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.